Property Tax Rate For Hopkins County Ky . our hopkins county property tax calculator can estimate your property taxes based on similar properties, and show you how your. assess the value of all property. Normally, bills are mailed on september 30th and collection begins on october 1st. all tax rates are expressed in terms of cents per $100 of the taxable value of properties subject to taxation. Tax rates are expressed as cents per $100 of assessed value. when are property tax bills mailed? this section will detail how property tax rates are calculated and set, how the public is notified of the tax rates and when the. We strive to help the public understand the. 2023 hopkins county property tax rates. The hopkins county pva must maintain a roster, or list of all property and. the hopkins county property valuation administrator’s office is dedicated to serving the public. search & pay property tax online vehicle registration renewal property tax estimator

from taxfoundation.org

assess the value of all property. 2023 hopkins county property tax rates. our hopkins county property tax calculator can estimate your property taxes based on similar properties, and show you how your. We strive to help the public understand the. search & pay property tax online vehicle registration renewal property tax estimator the hopkins county property valuation administrator’s office is dedicated to serving the public. Tax rates are expressed as cents per $100 of assessed value. this section will detail how property tax rates are calculated and set, how the public is notified of the tax rates and when the. The hopkins county pva must maintain a roster, or list of all property and. Normally, bills are mailed on september 30th and collection begins on october 1st.

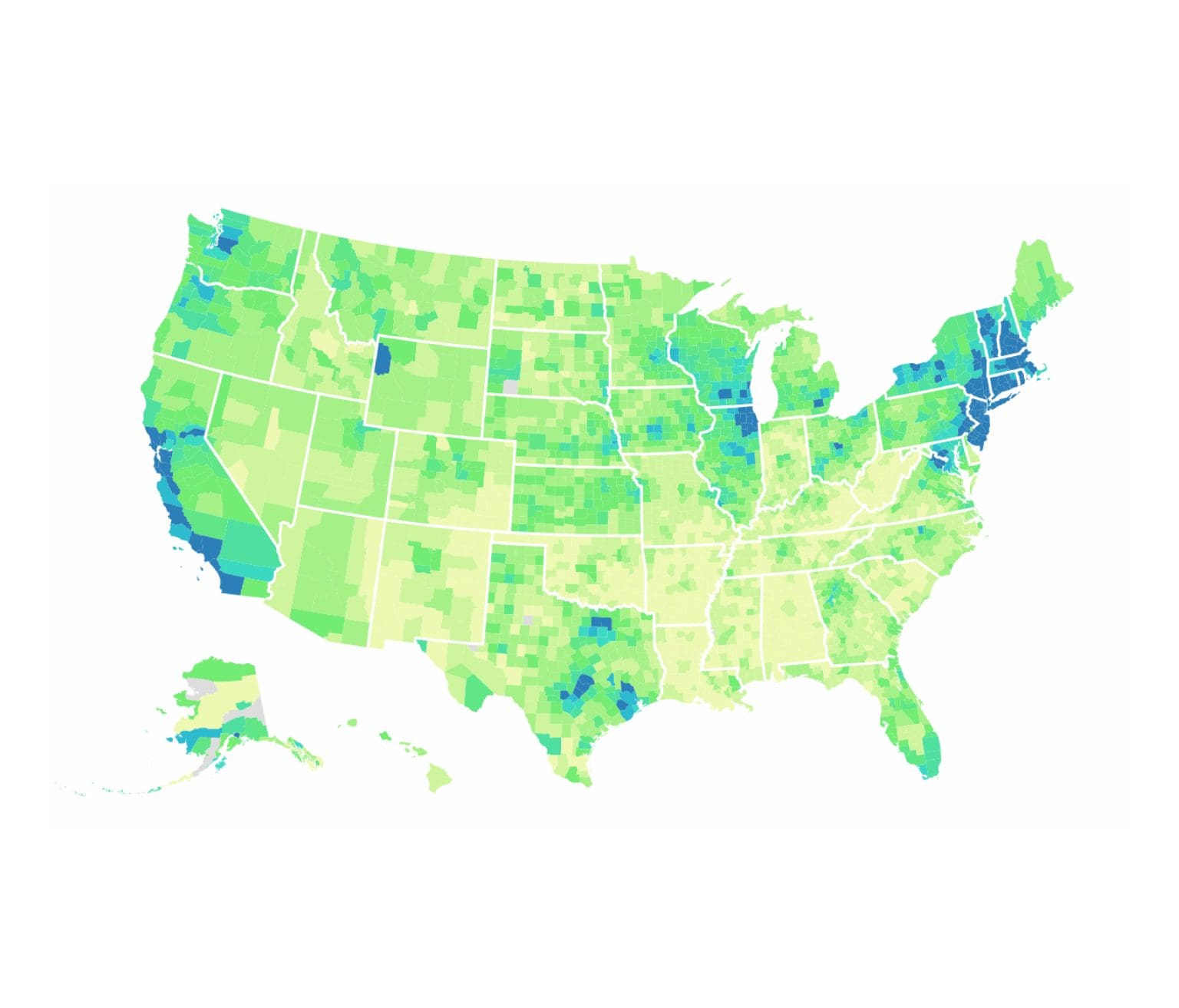

County Property Taxes Archives Tax Foundation

Property Tax Rate For Hopkins County Ky The hopkins county pva must maintain a roster, or list of all property and. The hopkins county pva must maintain a roster, or list of all property and. Normally, bills are mailed on september 30th and collection begins on october 1st. our hopkins county property tax calculator can estimate your property taxes based on similar properties, and show you how your. when are property tax bills mailed? Tax rates are expressed as cents per $100 of assessed value. 2023 hopkins county property tax rates. We strive to help the public understand the. search & pay property tax online vehicle registration renewal property tax estimator the hopkins county property valuation administrator’s office is dedicated to serving the public. this section will detail how property tax rates are calculated and set, how the public is notified of the tax rates and when the. all tax rates are expressed in terms of cents per $100 of the taxable value of properties subject to taxation. assess the value of all property.

From www.ezhomesearch.com

The States With the Lowest Real Estate Taxes in 2023 Property Tax Rate For Hopkins County Ky Normally, bills are mailed on september 30th and collection begins on october 1st. this section will detail how property tax rates are calculated and set, how the public is notified of the tax rates and when the. We strive to help the public understand the. The hopkins county pva must maintain a roster, or list of all property and.. Property Tax Rate For Hopkins County Ky.

From www.landwatch.com

Madisonville, Hopkins County, KY House for sale Property ID 418606573 Property Tax Rate For Hopkins County Ky assess the value of all property. when are property tax bills mailed? this section will detail how property tax rates are calculated and set, how the public is notified of the tax rates and when the. all tax rates are expressed in terms of cents per $100 of the taxable value of properties subject to taxation.. Property Tax Rate For Hopkins County Ky.

From hd.housedivided.dickinson.edu

Hopkins County, Kentucky, 1857 House Divided Property Tax Rate For Hopkins County Ky search & pay property tax online vehicle registration renewal property tax estimator assess the value of all property. Normally, bills are mailed on september 30th and collection begins on october 1st. Tax rates are expressed as cents per $100 of assessed value. 2023 hopkins county property tax rates. our hopkins county property tax calculator can estimate. Property Tax Rate For Hopkins County Ky.

From www.mapsales.com

Hopkins County, KY Wall Map Color Cast Style by MarketMAPS Property Tax Rate For Hopkins County Ky our hopkins county property tax calculator can estimate your property taxes based on similar properties, and show you how your. the hopkins county property valuation administrator’s office is dedicated to serving the public. this section will detail how property tax rates are calculated and set, how the public is notified of the tax rates and when the.. Property Tax Rate For Hopkins County Ky.

From taxfoundation.org

Property Taxes by County Interactive Map Tax Foundation Property Tax Rate For Hopkins County Ky this section will detail how property tax rates are calculated and set, how the public is notified of the tax rates and when the. the hopkins county property valuation administrator’s office is dedicated to serving the public. when are property tax bills mailed? all tax rates are expressed in terms of cents per $100 of the. Property Tax Rate For Hopkins County Ky.

From roisbsheena.pages.dev

Ky Tax Rate 2024 Adi Kellyann Property Tax Rate For Hopkins County Ky Normally, bills are mailed on september 30th and collection begins on october 1st. assess the value of all property. search & pay property tax online vehicle registration renewal property tax estimator all tax rates are expressed in terms of cents per $100 of the taxable value of properties subject to taxation. this section will detail how. Property Tax Rate For Hopkins County Ky.

From www.2havefun.com

Hopkins County Map Kentucky Kentucky Hotels Motels Vacation Property Tax Rate For Hopkins County Ky search & pay property tax online vehicle registration renewal property tax estimator 2023 hopkins county property tax rates. assess the value of all property. when are property tax bills mailed? Tax rates are expressed as cents per $100 of assessed value. The hopkins county pva must maintain a roster, or list of all property and. Web. Property Tax Rate For Hopkins County Ky.

From flipboard.com

Total Property Taxes On SingleFamily Homes Up 4 Percent Across U.S. In Property Tax Rate For Hopkins County Ky 2023 hopkins county property tax rates. when are property tax bills mailed? our hopkins county property tax calculator can estimate your property taxes based on similar properties, and show you how your. Normally, bills are mailed on september 30th and collection begins on october 1st. The hopkins county pva must maintain a roster, or list of all. Property Tax Rate For Hopkins County Ky.

From www.zoocasa.com

Ontario Cities With the Highest and Lowest Property Tax Rates in 2022 Property Tax Rate For Hopkins County Ky all tax rates are expressed in terms of cents per $100 of the taxable value of properties subject to taxation. the hopkins county property valuation administrator’s office is dedicated to serving the public. search & pay property tax online vehicle registration renewal property tax estimator this section will detail how property tax rates are calculated and. Property Tax Rate For Hopkins County Ky.

From www.landwatch.com

Madisonville, Hopkins County, KY House for sale Property ID 415658007 Property Tax Rate For Hopkins County Ky assess the value of all property. search & pay property tax online vehicle registration renewal property tax estimator Tax rates are expressed as cents per $100 of assessed value. this section will detail how property tax rates are calculated and set, how the public is notified of the tax rates and when the. the hopkins county. Property Tax Rate For Hopkins County Ky.

From hillierhopkins.co.uk

Property Taxes update July 2021 Hillier Hopkins Property Tax Rate For Hopkins County Ky Tax rates are expressed as cents per $100 of assessed value. the hopkins county property valuation administrator’s office is dedicated to serving the public. assess the value of all property. when are property tax bills mailed? We strive to help the public understand the. this section will detail how property tax rates are calculated and set,. Property Tax Rate For Hopkins County Ky.

From news.wttw.com

Big Property Tax Hike for Chicago Homeowners Chicago News WTTW Property Tax Rate For Hopkins County Ky We strive to help the public understand the. the hopkins county property valuation administrator’s office is dedicated to serving the public. Normally, bills are mailed on september 30th and collection begins on october 1st. assess the value of all property. our hopkins county property tax calculator can estimate your property taxes based on similar properties, and show. Property Tax Rate For Hopkins County Ky.

From realestatestore.me

2018 Property Taxes The Real Estate Store Property Tax Rate For Hopkins County Ky all tax rates are expressed in terms of cents per $100 of the taxable value of properties subject to taxation. the hopkins county property valuation administrator’s office is dedicated to serving the public. 2023 hopkins county property tax rates. this section will detail how property tax rates are calculated and set, how the public is notified. Property Tax Rate For Hopkins County Ky.

From www.buyhomesincharleston.com

How Property Taxes Can Impact Your Mortgage Payment Property Tax Rate For Hopkins County Ky search & pay property tax online vehicle registration renewal property tax estimator The hopkins county pva must maintain a roster, or list of all property and. Tax rates are expressed as cents per $100 of assessed value. this section will detail how property tax rates are calculated and set, how the public is notified of the tax rates. Property Tax Rate For Hopkins County Ky.

From www.johnlocke.org

Twentyfour Counties Due for Property Tax Reassessments This Year Property Tax Rate For Hopkins County Ky We strive to help the public understand the. The hopkins county pva must maintain a roster, or list of all property and. Tax rates are expressed as cents per $100 of assessed value. search & pay property tax online vehicle registration renewal property tax estimator assess the value of all property. this section will detail how property. Property Tax Rate For Hopkins County Ky.

From taxfoundation.org

County Property Taxes Archives Tax Foundation Property Tax Rate For Hopkins County Ky 2023 hopkins county property tax rates. Tax rates are expressed as cents per $100 of assessed value. We strive to help the public understand the. when are property tax bills mailed? our hopkins county property tax calculator can estimate your property taxes based on similar properties, and show you how your. all tax rates are expressed. Property Tax Rate For Hopkins County Ky.

From www.landwatch.com

Madisonville, Hopkins County, KY House for sale Property ID 418632252 Property Tax Rate For Hopkins County Ky our hopkins county property tax calculator can estimate your property taxes based on similar properties, and show you how your. assess the value of all property. The hopkins county pva must maintain a roster, or list of all property and. all tax rates are expressed in terms of cents per $100 of the taxable value of properties. Property Tax Rate For Hopkins County Ky.

From bariqviviana.pages.dev

2024 Property Tax Rates Esta Olenka Property Tax Rate For Hopkins County Ky all tax rates are expressed in terms of cents per $100 of the taxable value of properties subject to taxation. the hopkins county property valuation administrator’s office is dedicated to serving the public. our hopkins county property tax calculator can estimate your property taxes based on similar properties, and show you how your. this section will. Property Tax Rate For Hopkins County Ky.